SEEK Advertised Salary Index - October 23

The SEEK Advertised Salary Index (ASI) measures the growth in advertised salaries for jobs posted on SEEK in Australia. The next quarterly SEEK ASI report will be released in February 2024 and will contain industry and state trends, as in this quarterly report. There will be monthly reports in December and January.

NATIONAL ADVERTISED SALARY TRENDS

- Advertised salaries rose by 0.3% in October, a slowdown from the previous three months.

- Year-on-year (y/y) advertised salary growth remains strong at 4.6%, but has slowed from the 4.8% recorded in both September and August.

STATE ADVERTISED SALARY TRENDS

- The smaller states led the nation in advertised salary growth, with South Australia up 5.4%.

- NSW (4.4%) and Victoria (4.0%) had relatively modest growth, reflecting ongoing sluggishness in labour demand in the larger states

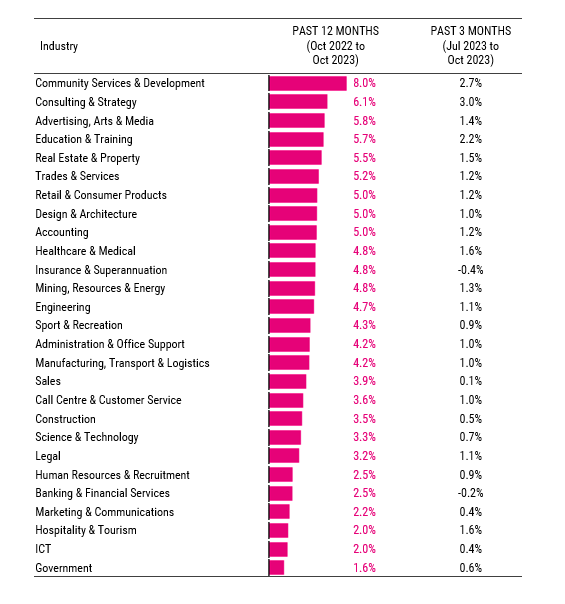

INDUSTRY ADVERTISED SALARY TRENDS

- Community Services & Development had the fastest growth in the SEEK ASI (8.0%), in large part because of the Fair Work Commission’s decision to raise wages for aged care workers, which had a noticeable effect on SEEK’s data in July and August.

- Government (1.6%) and ICT (2.0%) continued to experience relatively weak growth in advertised salaries.

NATIONAL ADVERTISED SALARY TRENDS

Advertised salaries grew rapidly in July and August, driven largely by award wage rises granted by the Fair Work Commission in its Annual Wage Review and aged care decisions. The effect of those decisions now appears to have passed.

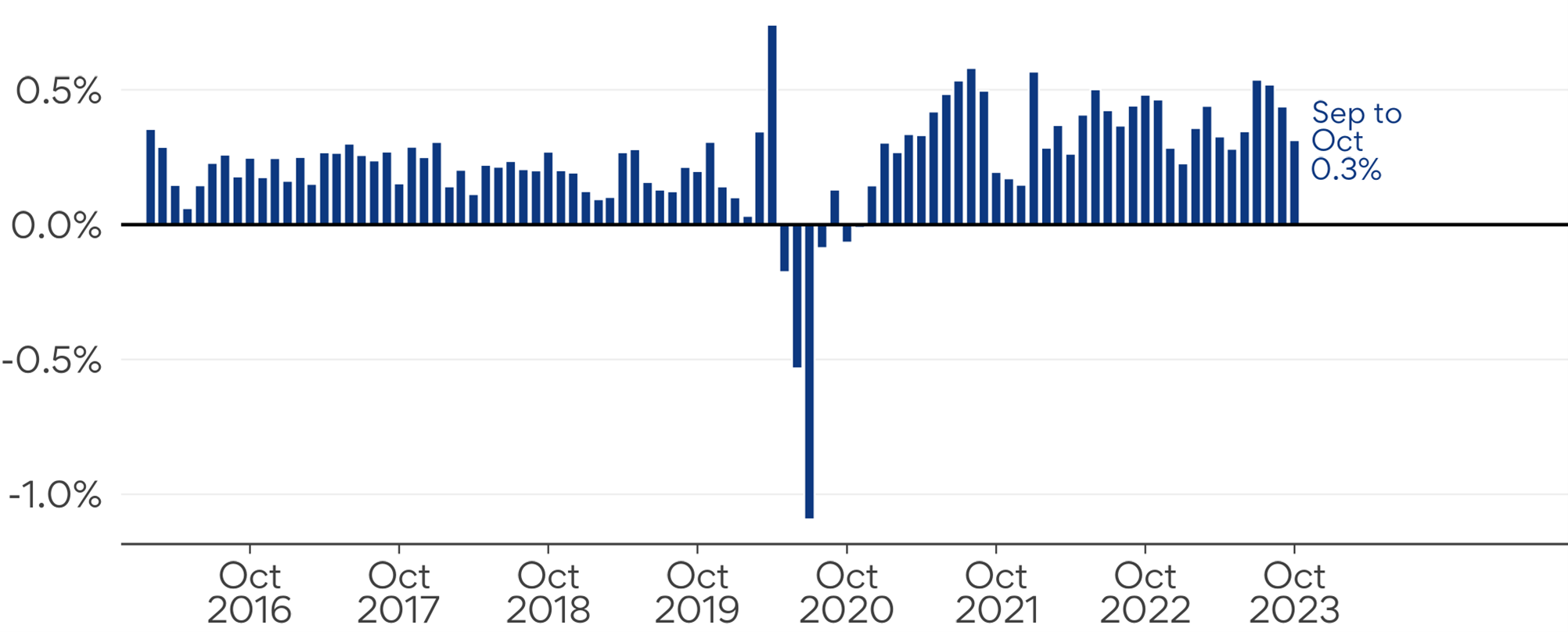

The SEEK ASI rose by 0.3% in October, a slowdown from the 0.4% recorded in September and 0.5% in each of July and August. Advertised salary growth has returned to where it was in the second quarter of 2023. If 0.3% growth were to be sustained for a full year, this would equate to 3.7% annual growth, which is slower than we’ve seen since the depths of 2020.

Figure 1: Month-on-month growth of SEEK Advertised Salary Index

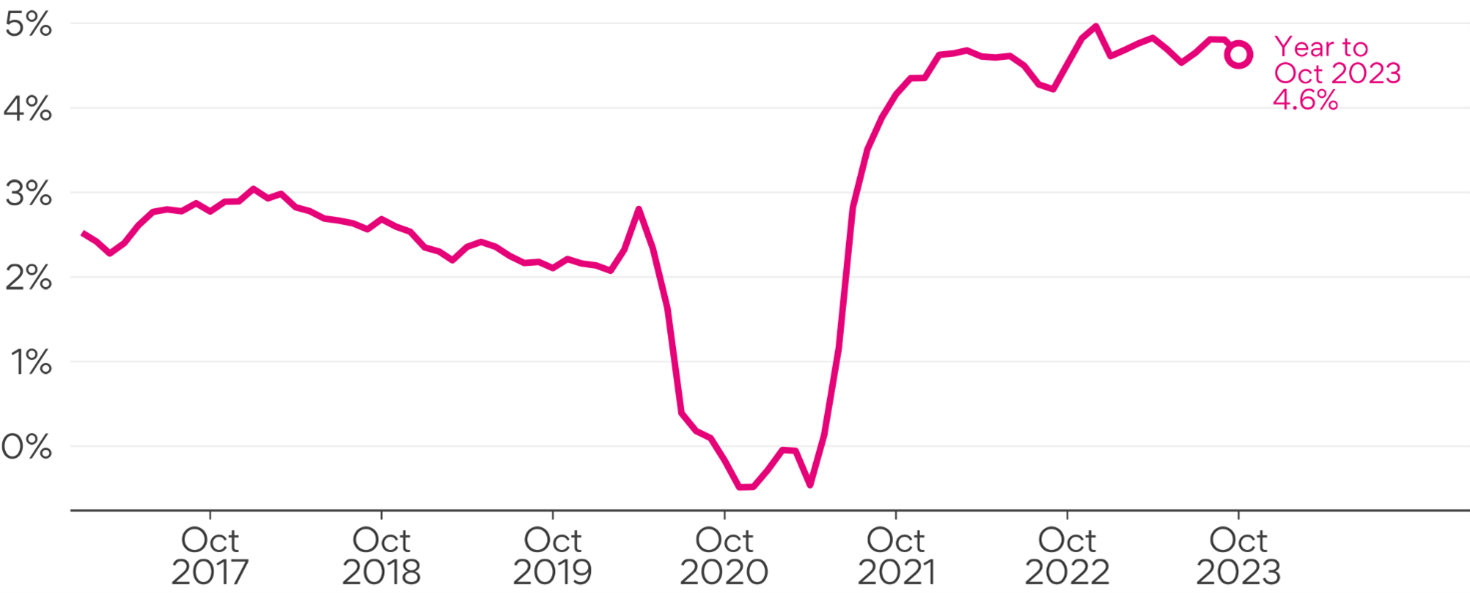

Y/y growth in the SEEK ASI also moderated in October, dipping to 4.6% from 4.8% in the prior two months and below the peak of 5% recorded in the year to December 2022.

Growth in the SEEK ASI remains strong, despite appearing to have peaked. Advertised salaries continue to grow faster (4.6%) than overall wages and salaries (4.0% according to the ABS Wage Price Index). This reflects the fact that the labour market remains tight, with an unemployment rate still near 50-year lows.

Advertised salary growth remains below inflation. The CPI rose by 5.4% in the year to the September quarter, so real wages and salaries have continued to decline.

Figure 2: Year-on-year growth of SEEK Advertised Salary Index

STATE ADVERTISED SALARY TRENDS

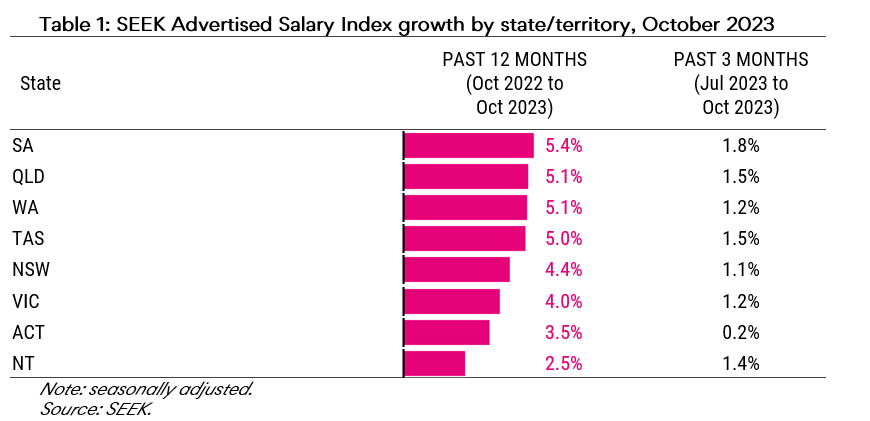

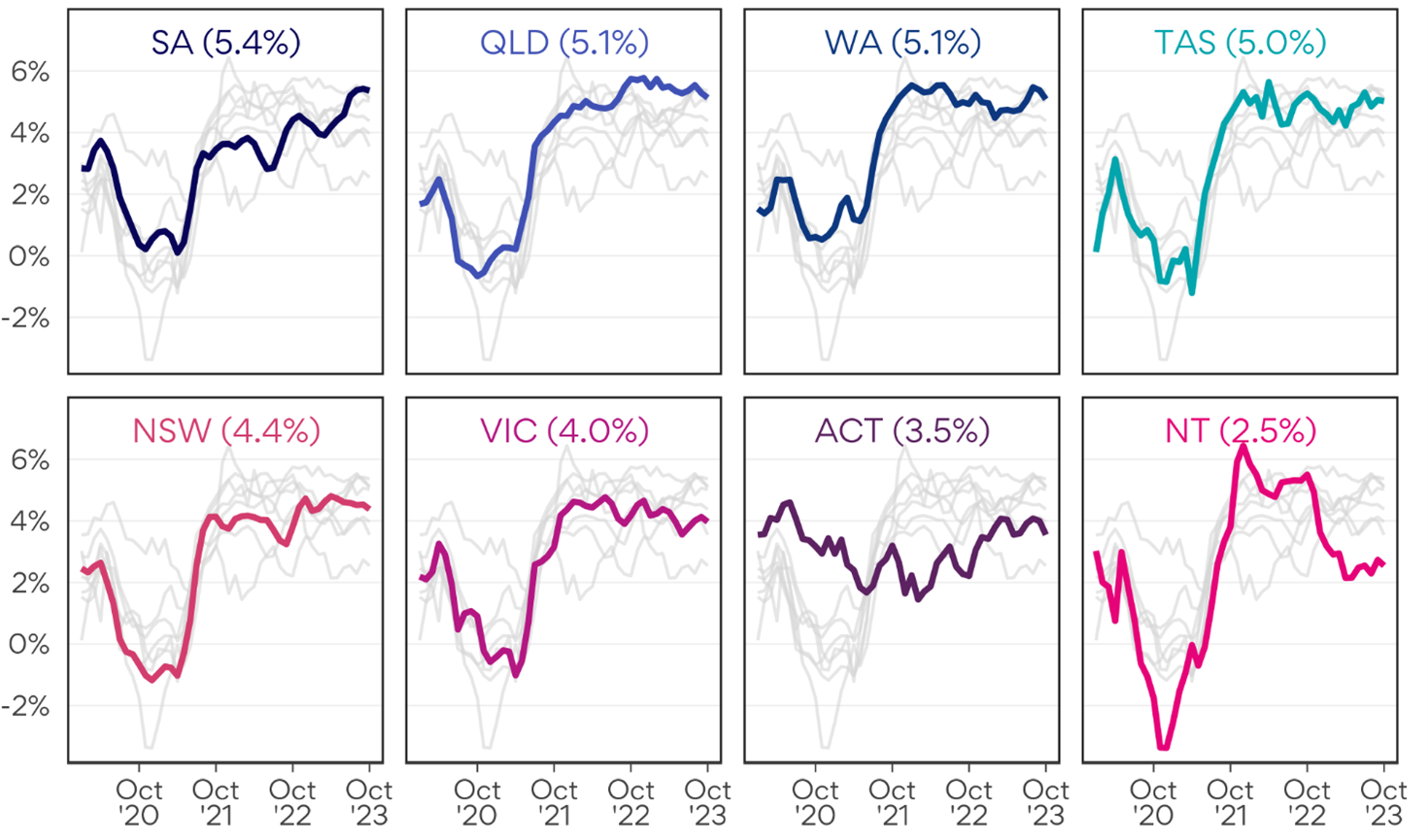

South Australia outpaced the nation in the year to October, with advertised salaries up 5.4%. The past 3 months have seen particularly strong SEEK ASI growth in the state, at 1.8% compared to the prior quarter. Queensland, Western Australia, and Tasmania all also recorded 5.0% or faster growth in advertised salaries in the past year.

Victoria and New South Wales lagged the other states, at 4.0% and 4.4% respectively. This is consistent with SEEK job ad volumes, which shows that labour demand in the most populous states has not been as strong as in the rest of Australia.

The territories experienced slower growth than any of the states over the year to October, with the Australian Capital Territory at 3.5% and the Northern Territory at just 2.5%. Canberra’s sluggishness is a continuation of a trend, with advertised salaries in SEEK’s Government classification lagging other industries.

Figure 3: Year-on-year growth of SEEK Advertised Salary Index by state/territory

INDUSTRY ADVERTISED SALARY TRENDS

Minimum wages in the aged care sector have risen by 15% since July, following a decision by the Fair Work Commission. That has propelled the Community Services & Development industry to the top of the ASI leaderboard over the year to October, with 8.0% advertised salary growth.

At the other end of the scale, advertised salary growth in Government continued to be very sluggish, at just 1.6% in the year to October. Information & Communication Technology didn’t fare much better, at 2.0% over the same period, reflecting continued weak labour demand from the sector.

Table 2: SEEK Advertised Salary Index growth by industry

– Notes –

The data for the SEEK ASI can be found here. When reporting SEEK data, we request that you attribute SEEK as the source and refer to SEEK as an employment marketplace.

Commentary relating to the SEEK ASI can be attributed to Matt Cowgill, SEEK Senior Economist.

About the SEEK ASI

The SEEK ASI measures the change in advertised salaries over time for jobs posted on SEEK in Australia, removing much of the effect of compositional change. The SEEK ASI is a complement to existing data about the growth in wages and salaries in Australia, including the ABS Wage Price Index (WPI). The WPI is a measure of the pace of wages growth across the economy, for jobs that are currently occupied. The SEEK ASI provides a timely and frequent read on the pulse of advertised salary growth in Australia for vacant roles.

More information about how the SEEK ASI is put together can be found here.

Disclaimer

The Data should be viewed and regarded as standalone information and should not be aggregated with any other information whether such information has been previously provided by SEEK Limited, ("SEEK"). The Data is given in summary form and whilst care has been taken in its preparation, SEEK makes no representations whatsoever about its completeness or accuracy. SEEK expressly bears no responsibility or liability for any reliance placed by you on the Data, or from the use of the Data by you. If you have received this message in error, please notify the sender immediately.