SEEK Advertised Salary Index | July

SEEK Senior Economist, Matt Cowgill, says:

“Advertised salary growth remains solid. After a few months of softer growth it has now ticked up slightly higher in July.

“The Fair Work Commission’s decision to raise award wages by 5.75% was likely a contributing factor here – but it’s notable that the most award-reliant industries, such as Hospitality & Tourism, didn’t see particularly strong growth.

“Workers in Queensland are enjoying the largest boosts, where advertised salaries have been growing since late 2021.

"The territories are recording the most sluggish growth, and in Victoria, where unemployment has risen, advertised salaries have slowed.

“Overall, advertised salary growth continues in the mid 4% range – neither accelerating greatly nor coming back down to the two to three percent more common before COVID.”

NATIONAL ADVERTISED SALARY TRENDS

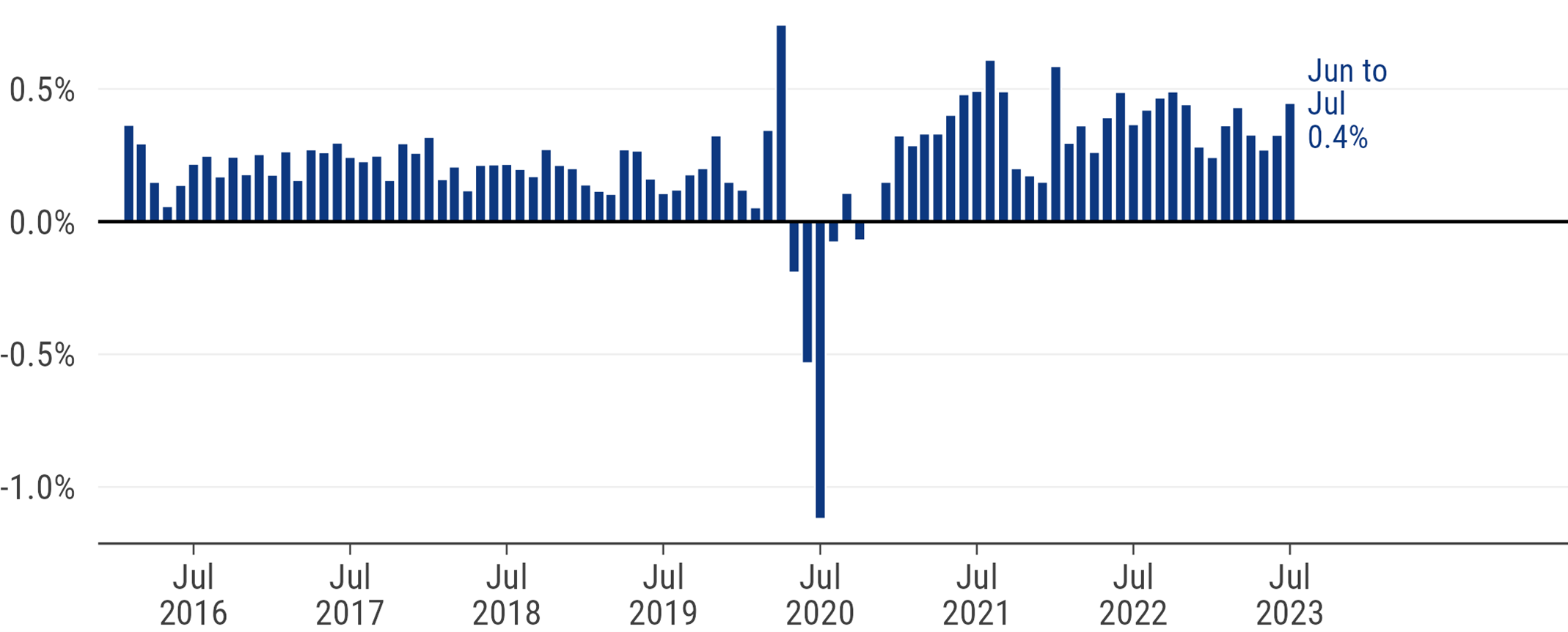

Advertised salary growth ticked up slightly in July, rising by 0.4% month-on-month after several months of 0.3% growth. Over the three months to July, advertised salaries rose by 1%. That’s broadly in line with the data over the first half of 2023, during which the three-month growth rate of the SEEK Advertised Salary Index has ranged between 0.9% and 1.1%.

While the advertised salary growth rates on a month-on-month basis can be somewhat volatile, the quarterly data tells a clear story: growth has moderated from the highs seen in late 2022 and 2021. In the three months to November 2022 growth was 1.4% and 1.6% in the three months to September 2021, but it remains robust and significantly above pre-COVID levels.

In July, the Fair Work Commission’s decision to raise all award wages by 5.75% took effect, with the national minimum wage increasing by 8.6%*. This is likely to have driven up advertised salary growth but has not impacted the overall Advertised Salary Index greatly.

Stronger labour demand generally pushes up advertised salaries and the increase in average advertised salaries in July also coincided with a slight increase in labour demand, with job ads on SEEK rising for the first time in several months.

*Very few employees in Australia (estimated at less than 1%) are paid directly on the National Minimum Wage, with most low-paid employees instead being paid according to an award. Awards specify legally binding minimum wages for particular occupations or industries.

Figure 1: Monthly growth of SEEK ASI

Note: Seasonally adjusted.

Source: SEEK.

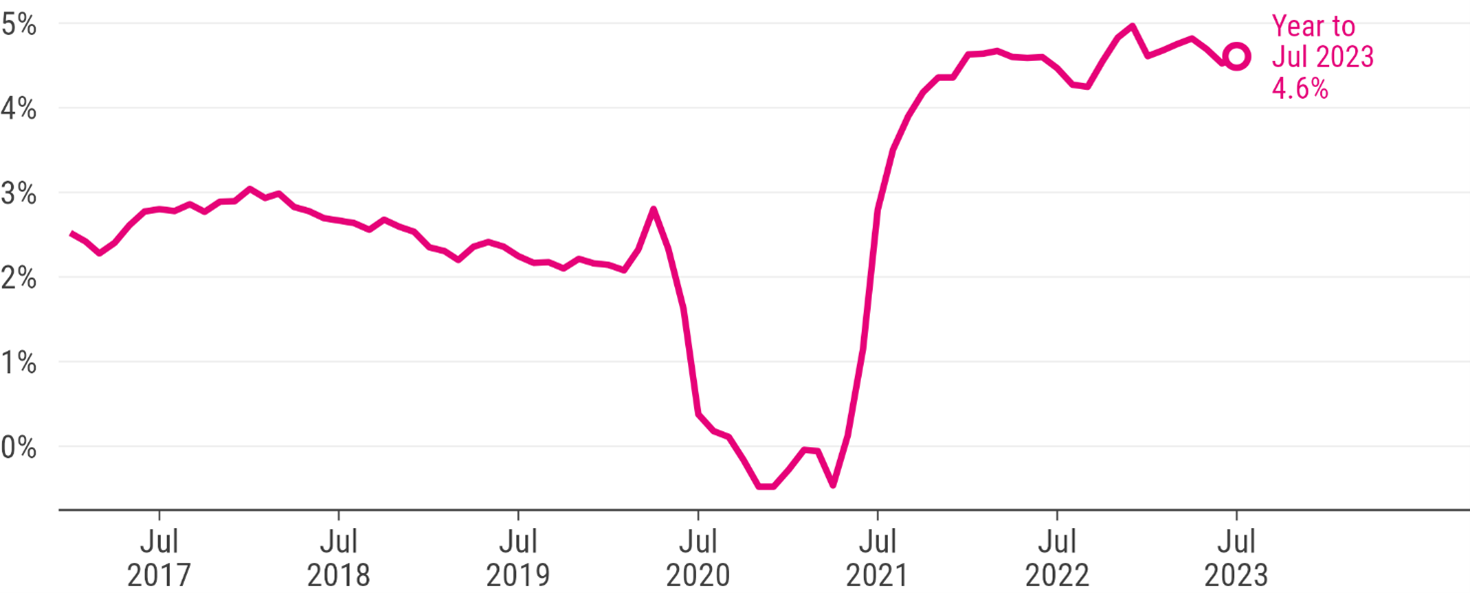

The slight monthly increase drove the annual growth in advertised salaries to 4.6% in July, from 4.5% in June. The year-on-year growth rate peaked at 5% in the year to December 2022 and has been broadly steady in the mid-4% range through 2023.

If quarterly growth in advertised salaries remains around 1%, the year-on-year growth rate should slow over the second half of the year to the low-4% range.

Figure 2: Annual growth of SEEK ASI

Note: Seasonally adjusted.

Source: SEEK.

STATE ADVERTISED SALARY TRENDS

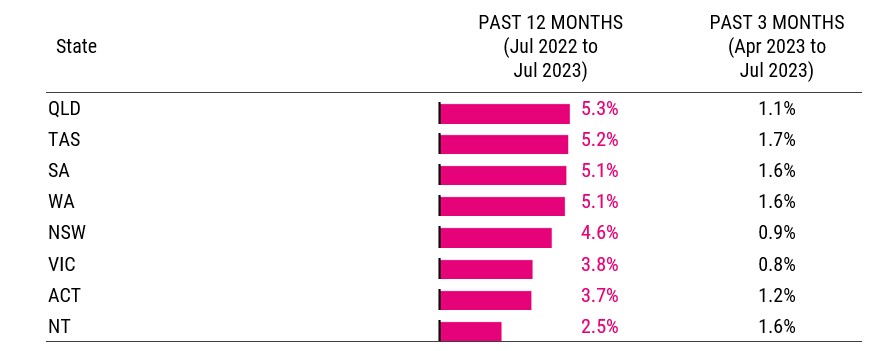

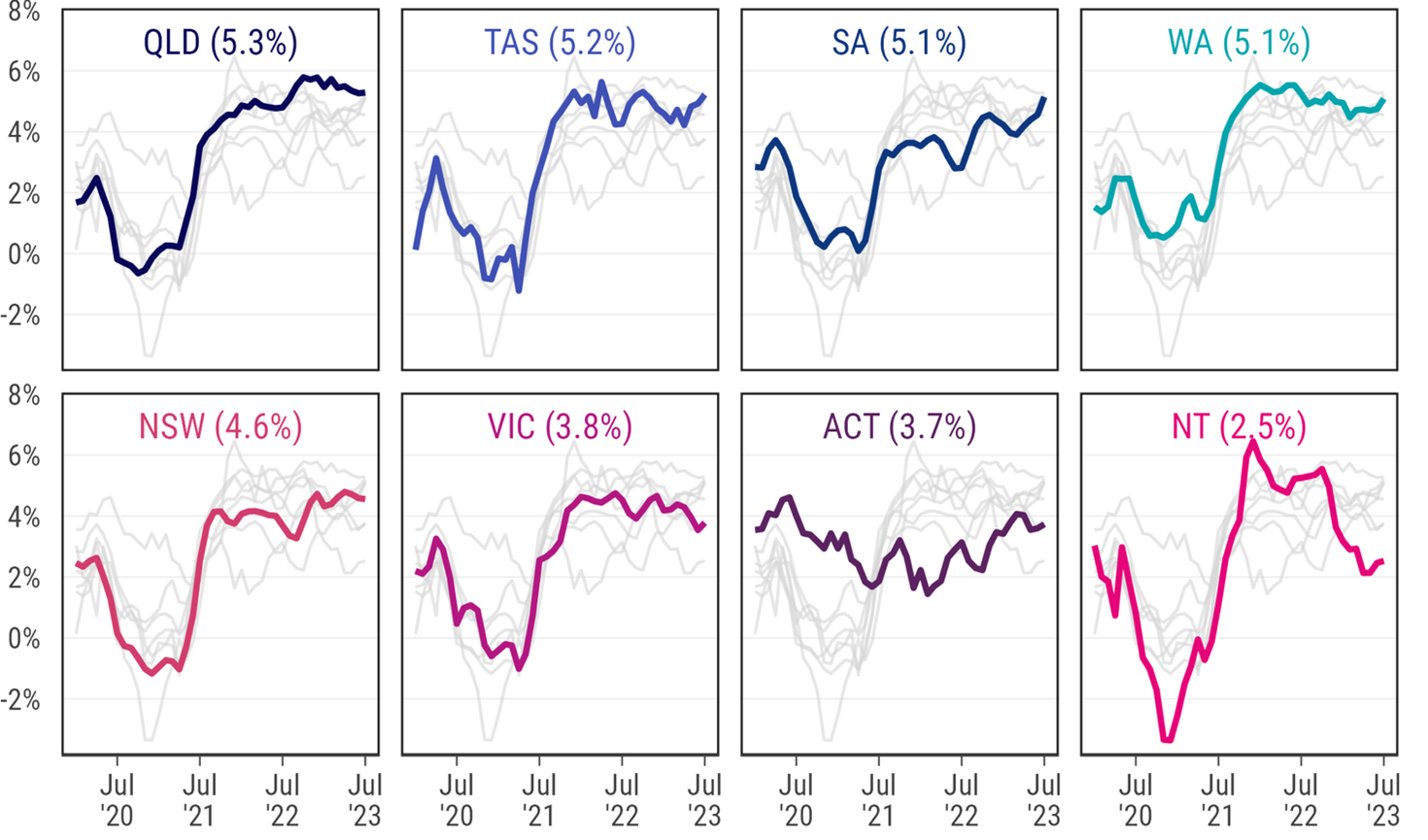

Advertised salaries in Queensland are booming, growing by 5.3% in the year to July 2023. Salary growth in Queensland has been consistently robust since late 2021.

The territories recorded slower growth than the states, with the Northern Territory, which has slowed materially since 2021, now at just 2.5% in the year to July. The Australian Capital Territory, which is at 3.7% in the year to July, has consistently lagged behind most states since mid-2021, in part reflecting ongoing sluggishness in the public sector.

Table 1: Growth of SEEK ASI by state/territory

The biggest states have diverged, with NSW continuing to record year-on-year advertised salary growth in the mid-4% range (4.6%) while Victoria has slowed to 3.8%.

This reflects the fact that the labour market is tighter in NSW, with unemployment at 3.2% in July 2023 compared to 3.4% in July 2022. In Victoria, unemployment was 3.6% in July 2023, unchanged from a year earlier.*

*Source: ABS Labour Force, July 2023, trend estimates.

Figure 3: Annual growth of SEEK ASI

INDUSTRY ADVERTISED SALARY TRENDS

The Trades & Services industry continues to go from strength to strength, recording advertised salary growth of 5.9% over the year to July. This is the most rapid growth of the larger industries, followed by Retail & Consumer Products (5.5%) and Construction (5.4%). Some smaller industries recorded faster growth – Insurance & Superannuation (9.2%) and Community Services & Development (6.7%), but these smaller industries can be more volatile.

The slowest growth was recorded in Government (0.9% year-on-year), continuing a trend of slow public sector growth. There’s no sign in the data of this turning around, with advertised salaries up a modest 0.3% in the 3 months to July.

Advertised salary growth has been modest in the Information & Communication Technology (ICT) industry, at just 1.8% in the year to July. This reflects ongoing sluggish demand for labour in ICT, with job advertisements down 35% year-on-year.

Table 2: Growth of SEEK ASI by industry

.jpg)

– Notes –

The data for the SEEK ASI can be found here.

When reporting SEEK data, we request that you attribute SEEK as the source and refer to SEEK as an employment marketplace.

Commentary relating to the SEEK ASI can be attributed to Matt Cowgill, SEEK Senior Economist.

About the SEEK ASI

The SEEK ASI measures the change in advertised salaries over time for jobs posted on SEEK in Australia, removing much of the effect of compositional change. The SEEK ASI is a complement to existing data about the growth in wages and salaries in Australia, including the ABS Wage Price Index (WPI). The WPI is a measure of the pace of wages growth across the economy, for jobs that are currently occupied. The SEEK ASI provides a timely and frequent read on the pulse of advertised salary growth in Australia for vacant roles.

More information about how the SEEK ASI is put together can be found here.

Disclaimer

The Data should be viewed and regarded as standalone information and should not be aggregated with any other information whether such information has been previously provided by SEEK Limited, ("SEEK"). The Data is given in summary form and whilst care has been taken in its preparation, SEEK makes no representations whatsoever about its completeness or accuracy. SEEK expressly bears no responsibility or liability for any reliance placed by you on the Data, or from the use of the Data by you. If you have received this message in error, please notify the sender immediately.