Job growth boosted by community services and healthcare

- SEEK job ads up 16.5 per cent in April compared to this time last year

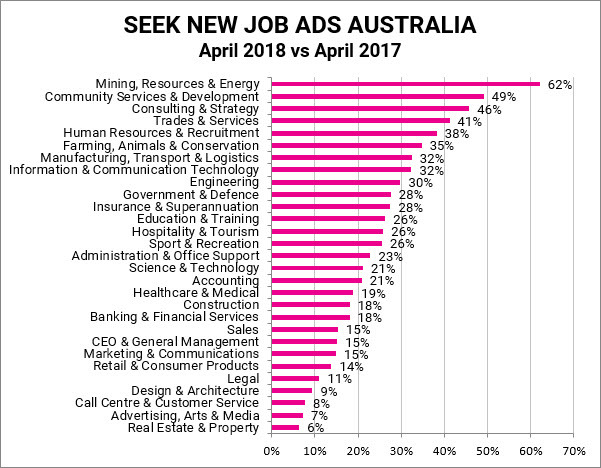

- Mining and Community Service sectors experience highest growth rates

- Rise of regional healthcare jobs across Australia

National new job ads recorded a rise of 16.5 per cent in April compared to this time last year, and experienced modest month-on-month growth of 1 per cent. The latest data from SEEK shows that every industry has recorded positive year-on-year (YoY) growth this month, with Mining, Resources & Energy experiencing an enormous 62 per cent increase in job ads compared to April 2017, followed by Community Services & Development which saw 49 per cent YoY growth.

New job ads in Mining, Resources & Energy increased across all states with Queensland (91% YoY), Victoria (86% YoY) and New South Wales (62% YoY) driving growth in the sector. Despite posting lower year on year job ad growth (51%) than its east coast counterparts, Western Australia was the largest contributor to the sector, accounting for 800 new job ads.

Queensland, Victoria and New South Wales are responsible for the vast majority of the new job ads in the Community Services industry (82%). The key occupation driving growth in Community Services is Aged and Disability Support, which makes up 33 per cent of the new job ads in April 2018 vs April 2017. This is followed by Employment Services (27%) and then Child Welfare (16%).

The Productivity Commission forecasts that Australia may need almost one million aged care workers by 2050 if it is to meet the anticipated demand from ageing baby boomers.

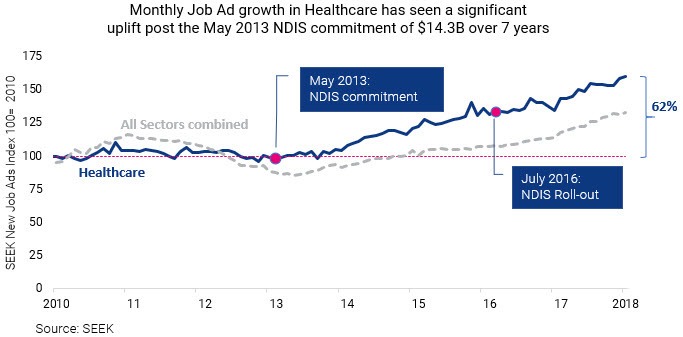

Kendra Banks, Managing Director SEEK ANZ, comments: “The strong growth in Community Services is driven mainly by aged and disability support workers, who are in high demand across Australia. This is thanks in part to Australia’s ageing population, but also the country-wide roll out of the National Disability Insurance Scheme (NDIS) which has had a positive impact on job ad growth over the past two years.”

Economists at Goldman Sachs estimate that around 50,000 jobs were created as a result of the NDIS in 2017, and another 100,000 may be expected by 2020. This is supported by SEEK data that shows significantly increased new job ads in both Community Services and Healthcare in April 2018 compared to the same time last year.

Trades & Services also experienced strong growth (up 41 per cent YoY), as did Consulting and Strategy (up 46 per cent YoY) and HR & Recruitment, which saw an increase of 38 per cent in job ads compared to twelve months ago.

Year-on-year job ad growth was also positive across every state and territory in April, with Tasmania topping the rankings with 35 per cent growth compared to April 2017. There were only two regions below the national average of 16.5 per cent in terms of seasonally adjusted year on year growth in April: NSW, where job ad growth was up 12.8 per cent YoY, and ACT which saw an 8.3 percent growth in job ads YoY.

Figure 1. SEEK job ad YoY growth, April 2018 vs April 2017

INDUSTRY FOCUS: HEALTHCARE IN AUSTRALIA

Healthcare is Australia’s biggest employer, and it is getting even bigger. Accounting for 13.7 per cent of the entire workforce (as of February 2018).

According to the Department of Jobs and Small Business Australian Jobs 2018 report, the healthcare and social assistance industry is projected to grow a further 16.1 per cent over the next five.

SEEK new job ad growth is directionally in line with this projection, and new job ads have increased significantly since the NDIS was launched in its trial phase in 2013. A clear upward trajectory can be seen over the past five years as the scheme has been rolled out across all states and territories.

Figure 2. Monthly job ad growth in healthcare: April 2010 - April 2018

The top roles contributing to growth in healthcare are Physiotherapy, Occupational Therapy & Rehabilitation, as well as Aged Care Nursing.

“As one of the sectors driving overall employment growth in Australia, the Healthcare industry recorded a 19 per cent year on year growth in April and saw more than 2,000 more new job ads than at the same time last year. There are a real variety of roles within both healthcare and community services that are experiencing significant growth thanks to our aging population, as well as the rise of chronic diseases which require on-going healthcare management and support.”

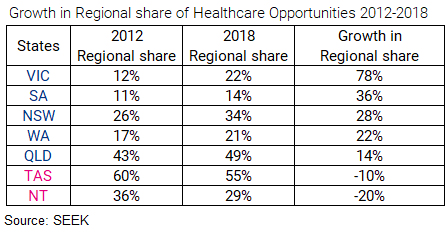

MOVING OUT: THE RISE OF REGIONAL HEALTHCARE

While the majority (68 per cent) of SEEK new job ads in healthcare are concentrated in the capital cities, overall growth has been fuelled by regional opportunities. Over the past seven years, the share of new job ads in healthcare in areas outside of capital cities has risen from 25 per cent to 32 per cent, demonstrating a significant shift from metro to regional areas.

The only areas bucking this trend are Tasmania and Northern Territory, where the healthcare sector has become more centralised in the same time period, with more new job ads appearing in Hobart and Darwin than in regional areas.

“Victoria leads the way when it comes to the biggest increase in the share of regional healthcare opportunities over the past 6 years,” Kendra Banks said. In 2012, just 12 per cent of healthcare job ads in Victoria were in regional areas, while current figures for 2018 show that this is now 22 per cent – equating to a 78 per cent increase over that period.

“This reflects a longer-term trend which has seen Victoria tilting the dial in its favour against New South Wales when it comes to the greatest share of new job ads in healthcare.”

Figure 3. Proportions of new healthcare job ads outside of capital cities by state

Download Employment Data Report

MEDIA NOTE: When reporting SEEK data, you must attribute SEEK as the source.

-- END--

About the SEEK Employment Report

The SEEK Employment Report provides a comprehensive overview of the Australian Employment Marketplace. The report includes the SEEK Employment Index (SEI), which is the first Australia aggregate indicator to measure the interaction between labour market supply and labour market demand.

It also includes the SEEK New Job Ad Index which measures only new job ads posted within the reported month to provide a clean measure of demand for labour across all classifications.

SEEK’s total job ad volume (not disclosed in this report) includes duplicated job advertisements and refreshed job ads. As a result, the SEEK New Job Ad Index does not always match the movement in SEEK’s total job ad volume.

Disclaimer: The Data should be viewed and regarded as standalone information and should not be aggregated with any other information whether such information has been previously provided by SEEK Limited, ("SEEK"). The Data is given in summary form and whilst care has been taken in its preparation, SEEK makes no representations whatsoever about its completeness or accuracy. SEEK expressly bears no responsibility or liability for any reliance placed by you on the Data, or from the use of the Data by you. If you have received this message in error, please notify the sender immediately.

About SEEK

SEEK is a diverse group of companies, comprised of a strong portfolio of online employment, educational, commercial and volunteer businesses. SEEK operates across 18 countries with exposure to over 4 billion people and 28 per cent of GDP. SEEK makes a positive contribution to people’s lives on a global scale. SEEK is listed on the Australian Securities Exchange, where it is a top 50 company with a market capitalisation close to A$6billion and has been listed in the Top 20 Most Innovative Companies Globally by Forbes, and Number One in Australia.