Where to for the Australian economy: Are we Wile E Coyote? Or The Road Runner?

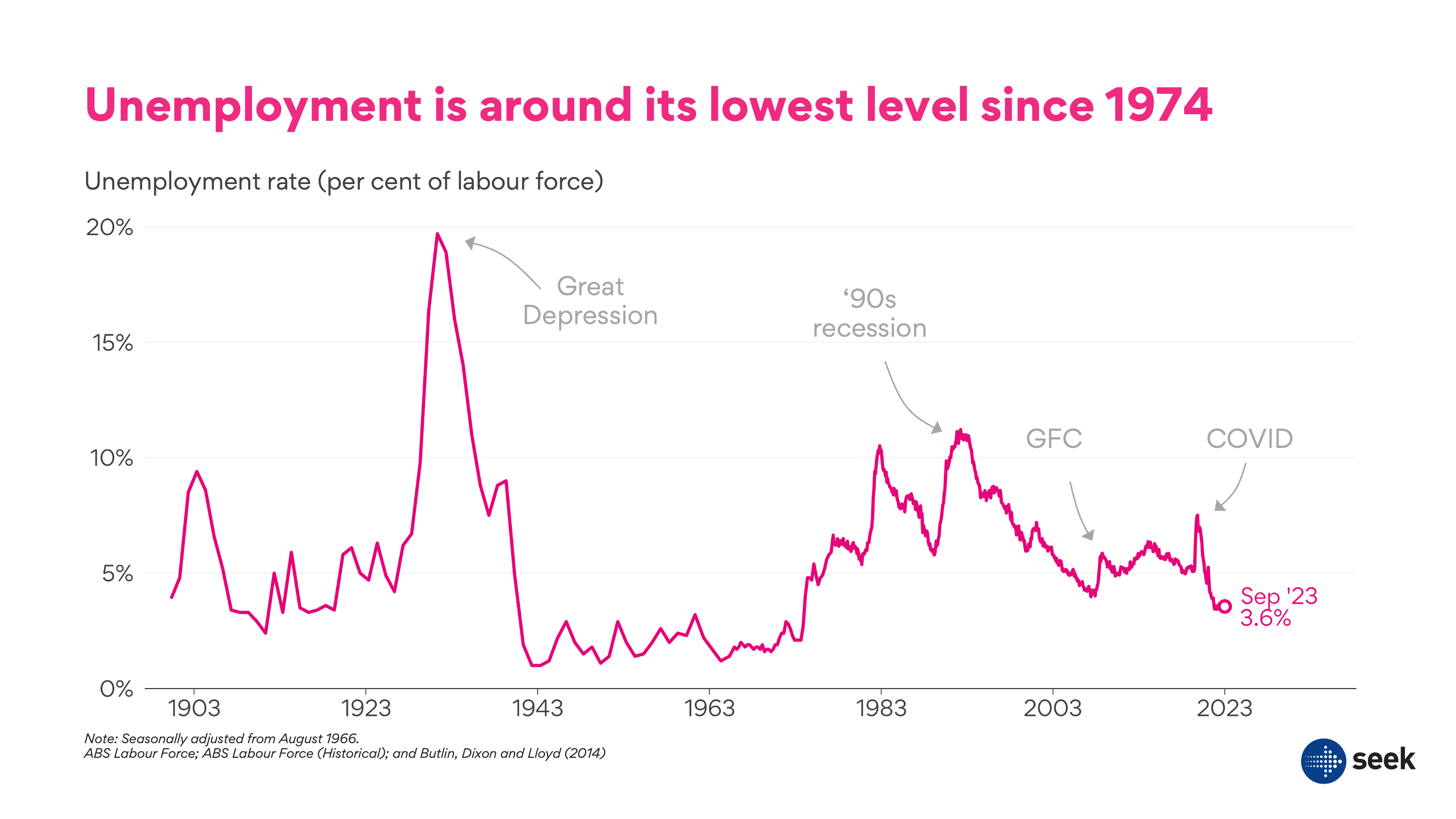

Even as the Reserve Bank of Australia has raised interest rates to bring inflation back into their target range, Australia’s unemployment rate has remained resiliently low. We crashed below the 4% barrier in early 2022, for the first time since 1974, and have stayed there ever since, with the unemployment rate bouncing around an extraordinarily low 3.4 to 3.7% since mid-2022.

But it’s widely expected that the good employment times are about to end. Interest rates have increased and when interest rates rise, unemployment usually follows. So, the key question facing the Australian labour market is: are we currently like Wile E Coyote, hanging in mid-air before we take a plunge? Or are we the Road Runner, set to gracefully come back to ground with a soft landing?

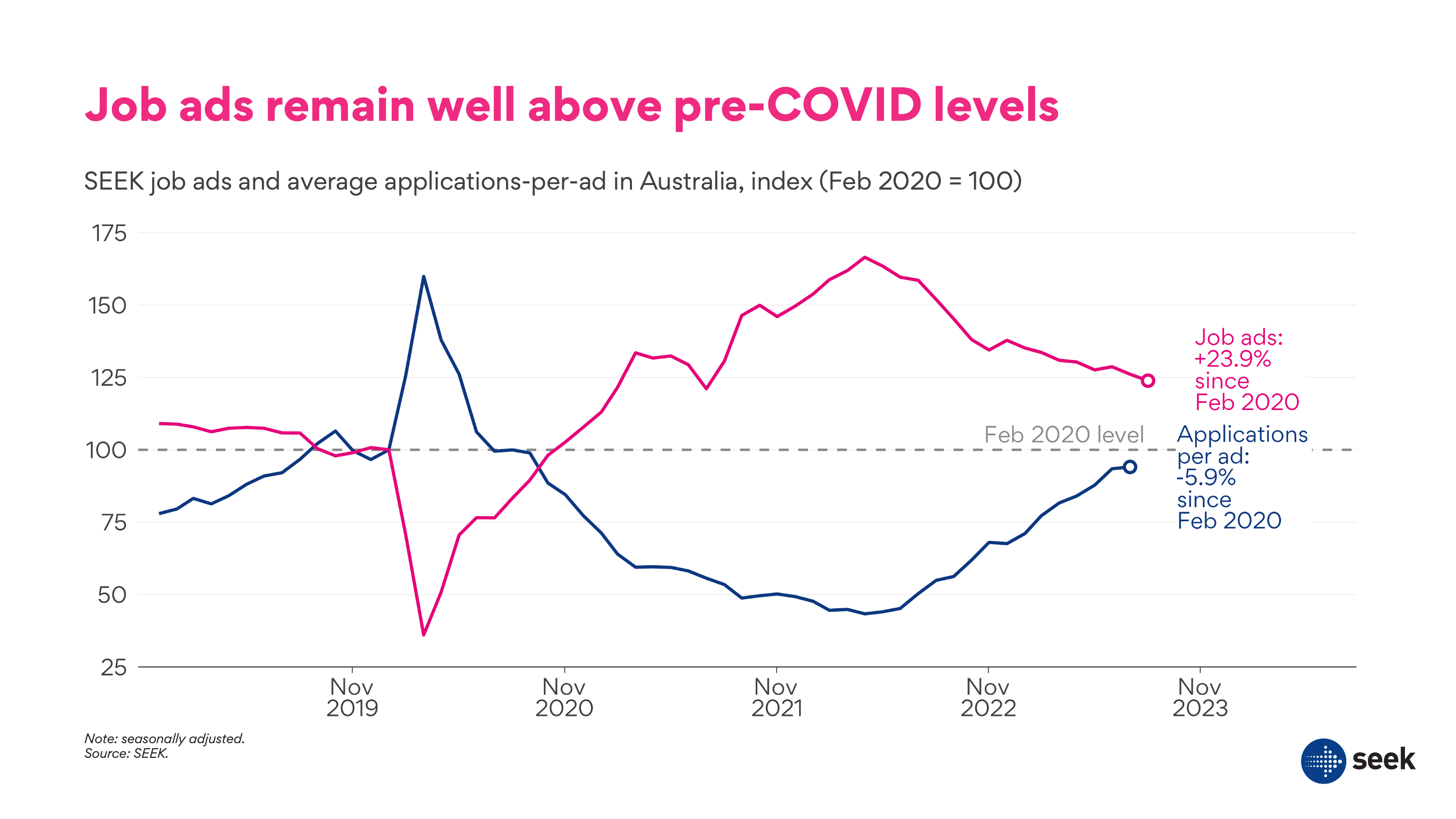

So far, most signs point to a soft landing. Job ads are a leading indicator of the labour market, and currently volumes remain well above pre-COVID levels. The number of jobs advertised on SEEK has moderated since the record highs of mid-2022, but the declines have been relatively small in recent months, and mixed with a small bump in July. Demand for workers remains strong.

The average number of applications per job ad – a good measure of the balance between the supply and demand for workers – is now around pre-COVID levels, reflecting the fact that this is still a tight labour market, with a lot of competition for talent.

Other forward-looking measures suggest that the labour market isn’t about to fall off a cliff. NAB’s Business Survey shows that businesses still report difficulty finding suitable labour. Businesses’ expectations for employment growth over the next three months and the next 12 months are also robust. Employment growth is expected to slow a little, but remain strong.

Others seem to agree. The Melbourne Institute regularly surveys households and asks them about what they expect to happen to unemployment. Unemployment expectations have risen – people expect the labour market to worsen – but they haven’t spiked. The unemployment expectations measure is around its long-term average, and below the levels we saw in 2019, before COVID hit.

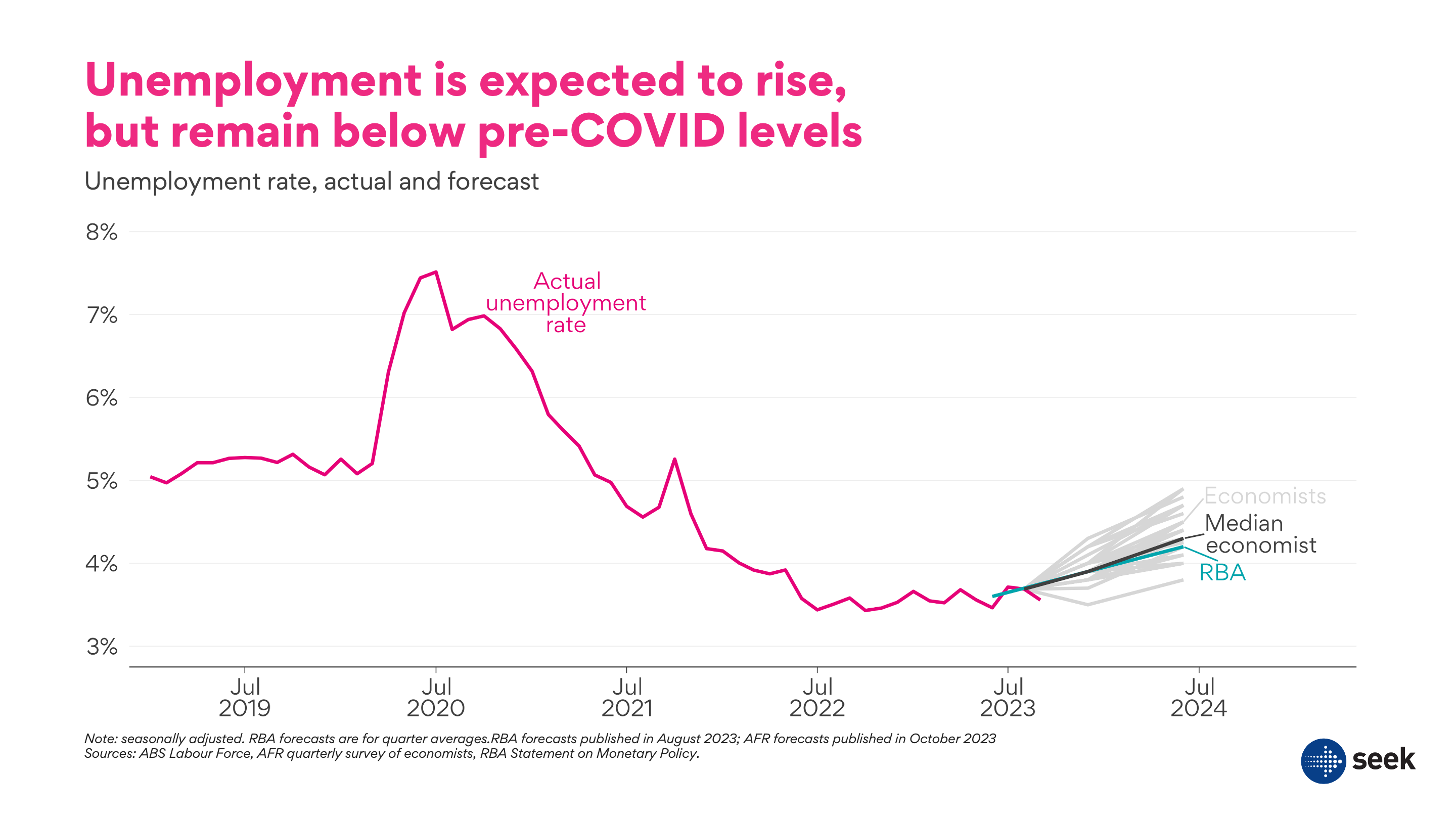

Forecasters also generally agree: unemployment is expected to rise over the next year or two, but the rise is expected to be relatively modest. The Reserve Bank expects unemployment to rise to 4.2% in mid 2024. Market economists surveyed by the Australian Financial Review broadly agree, with the median economist tipping a slightly sharper rise to 4.3% by June 2024.

Thankfully, not a single economist surveyed by the Financial Review expects unemployment to rise above the 5% mark in mid-2024. Unemployment is expected to remain comfortably below where it was in late 2019 and early 2020, before COVID hit. Any rise in unemployment brings with it real pain for the people and families affected by it, but thankfully it looks like Australia’s on track for a soft landing, with a relatively modest rise in joblessness.

The labour market has surprised many observers with how resilient it has been. In January of this year, the median market economist was tipping a 4.2% unemployment rate for December 2023; now they expect 3.9%. So far the Australian labour market looks like Wile-E Coyote – it just keeps on going.

-ENDS-

About Matt Cowgill

Matt Cowgill is SEEK’s Senior Economist, a position he has held since late 2021. At SEEK, Matt focuses on leveraging SEEK’s unique data to develop insights about the labour market.

Matt’s experience in analysing the labour market has been developed at Grattan Institute, the International Labour Organization, the Victorian Government and elsewhere.

Matt has a Masters in Economic Policy from the University of London, and undergraduate degrees in economics and political science from the University of Western Australia.