Economist Insights

Work-from-home hasn’t gone anywhere

Despite a softening labour market, the proportion of job ads offering WFH remains high

The world of work usually changes slowly, like tectonic plates moving beneath the surface. Previous shifts, like the fall in the proportion of people employed in agriculture and manufacturing, have taken place over the course of several decades. But the shift towards remote and hybrid work happened very rapidly, like an earthquake, with the onset of COVID lockdowns in March 2020.

Two years on from the last lockdowns in Australia, work from home is still a feature of our labour market. The proportion of job ads that indicate that a role can be done from home remains dramatically higher than it was in 2019.

The WFH rate has fallen a little, but remains much higher than pre-COVID levels

We measure the work from home (WFH) rate by counting how many job ads indicate that the role can be done remotely, as a proportion of all job ads in a particular month. To do this, we look for ads that include at least one WFH-related keyword or phrase, such as “hybrid work”, “work from anywhere”, and so on. SEEK’s unique data, covering hundreds of thousands of newly-advertised jobs every month in Australia, means we can track these trends over time.

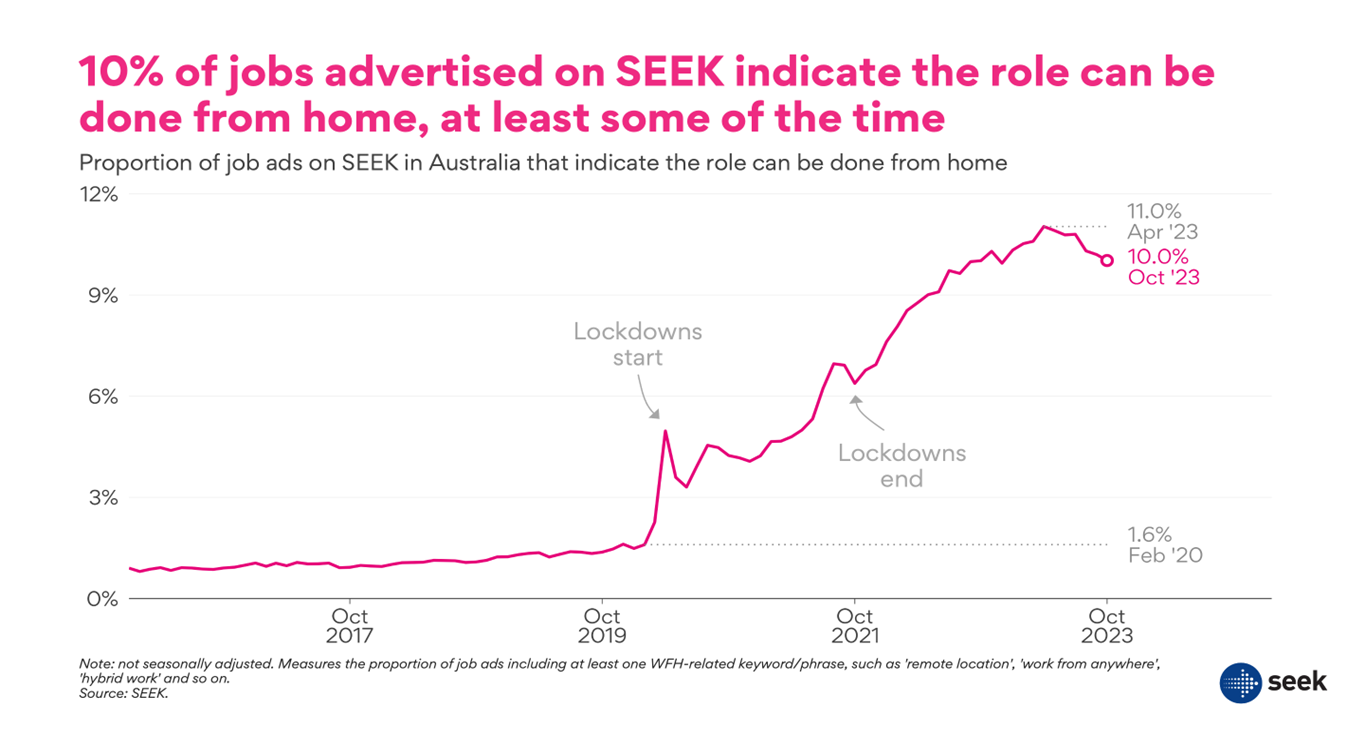

Before COVID hit, very few job advertisements indicated that the role could be done from home, just 1.6% in February 2020. The ability to work from home for even part of the work week was a fairly niche, uncommon feature of jobs before the pandemic.

The WFH rate rose sharply during the initial lockdown period and kept on rising. Since lockdowns ended in Australia in October 2021, there’s been no sign of remote work returning to anything like the pre-COVID levels.

On the contrary, the WFH rate kept rising long after lockdowns were over. The rate rose from a little over 6% of job ads in late 2021 to a peak of 11% in April 2023. Since then, it has fallen a little, sitting at 10% in October. This is still far above pre-COVID levels, and substantially higher than the highest rate recorded during lockdowns.

At 10%, the WFH rate remains above the 9% recorded in May 2022, when the Great Job Boom reached its peak. Since May ’22, labour demand has cooled and the average number of applications per job ad has increased substantially, yet WFH has risen as a share of all job ads. This shows that the ability to work from home at least some of the time was not a perk that employers were only offering during the period of peak labour market tightness. Even as the market is moving to a more normal balance between supply and demand, the proportion of job ads offering the ability to work from home has remained high.

The WFH rate hasn’t fallen in most industries

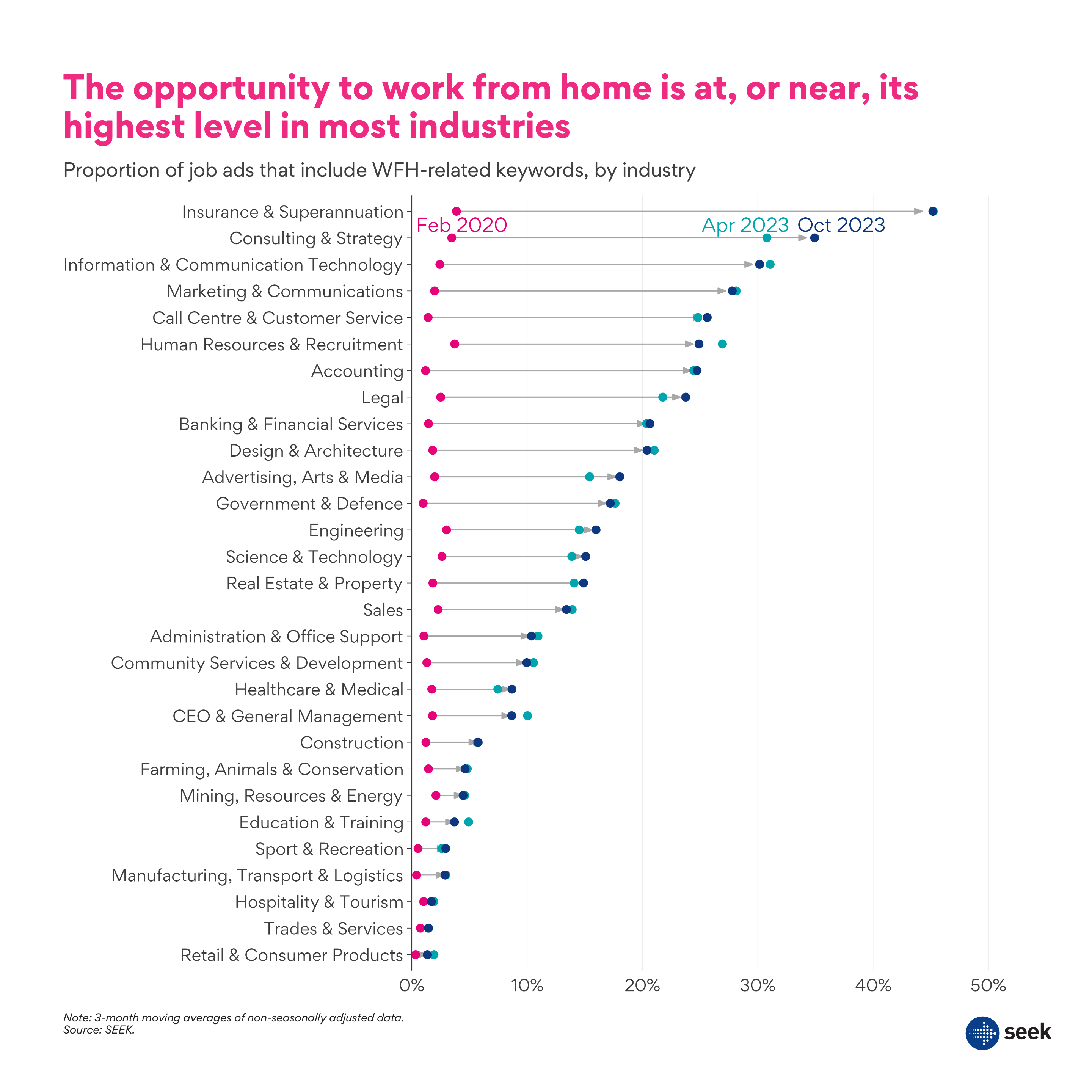

Most industries are either at – or very near – their highest level of WFH when it comes to job ads. For example, 45.2% of job ads in Finance & Insurance in October 2023 indicated they could be done from home – unchanged from the peak in April 2023, and dramatically higher than the 3.8% recorded in February 2020. The WFH rate in Consulting & Strategy was 34.9% in October, up from 30.8% in April.

In industries where the WFH rate fell between April and October 2023, the fall was generally small. For example, the Information & Communication Technology (ICT) industry record only a modest decline, from 31% in April to 30% in October.

Slight decline in WFH jobs is due to compositional change

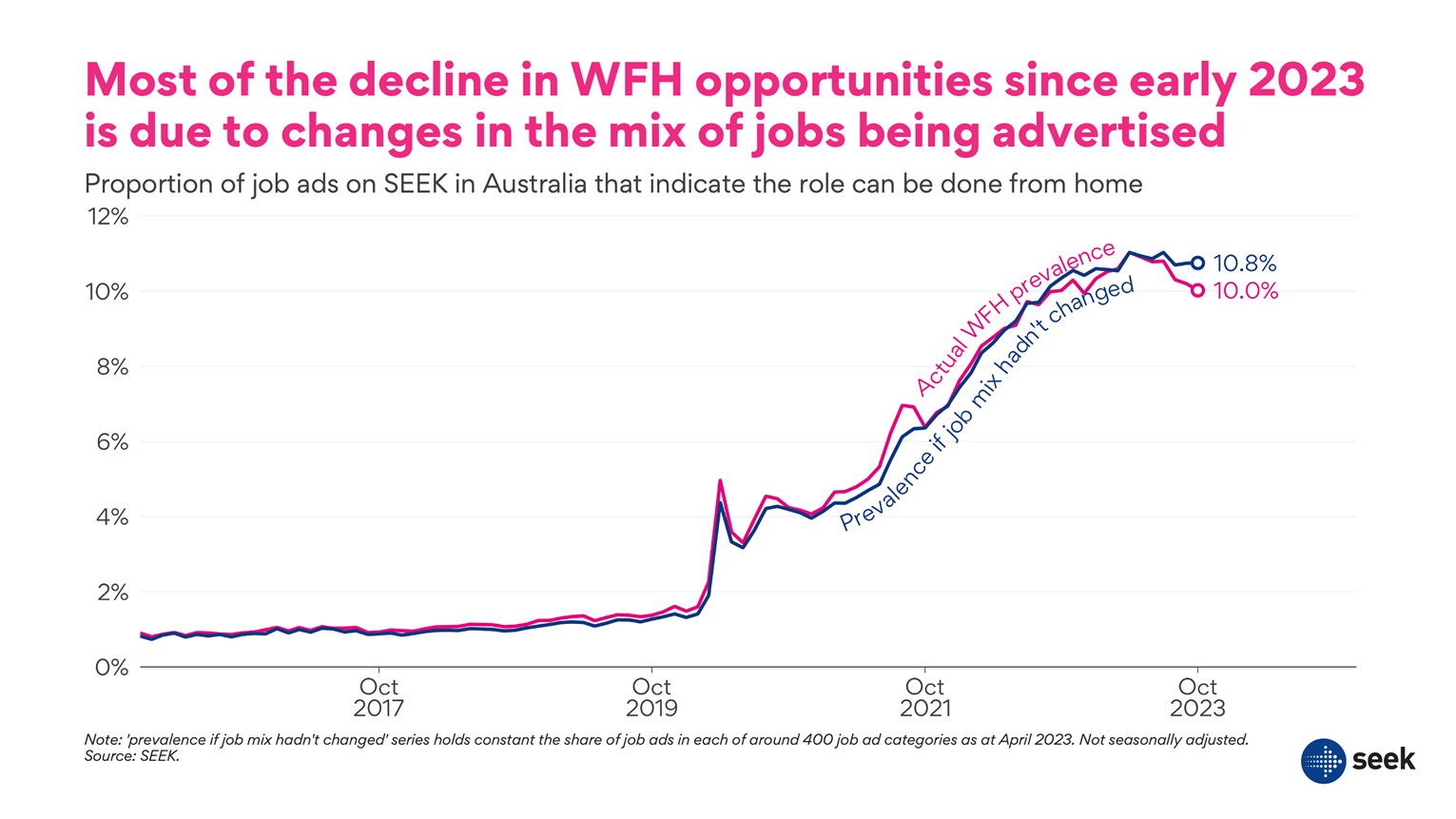

Overall, the proportion of job ads offering the ability to work from home has fallen a little – from 11% in April to 10% in October 2023 – but the rate in most industries is at or near a record high. How can we reconcile those two facts?

The answer: the fall in the overall WFH rate is mostly due to compositional changes between industries on the SEEK platform, not declines in the proportion of jobs advertised as WFH within individual industries. White collar professional industries like ICT and Finance where WFH is more prevalent have experienced a bigger decline in overall job ads than other industries where remote work is less common. It’s this relative decline in white collar ads overall – not a fall within individual industries – that is driving the headline figures.

To quantify the effect that changes in the mix of jobs has had on the overall WFH rate, we can calculate what the rate would’ve looked like if the job mix hadn’t changed. The WFH rate fell by 1 percentage point between April and October, from 11% to 10%. But if the mix of jobs being advertised hadn’t changed over this period, the rate would only have fallen from 11% to 10.8% – a much smaller 0.2 percentage point decline. Most (80%) of the decline in WFH opportunities is therefore due to changes in the overall type of jobs being advertised – not a fall in the likelihood that a job of a given type is offered as a WFH job.

Working from home is more common in the big states

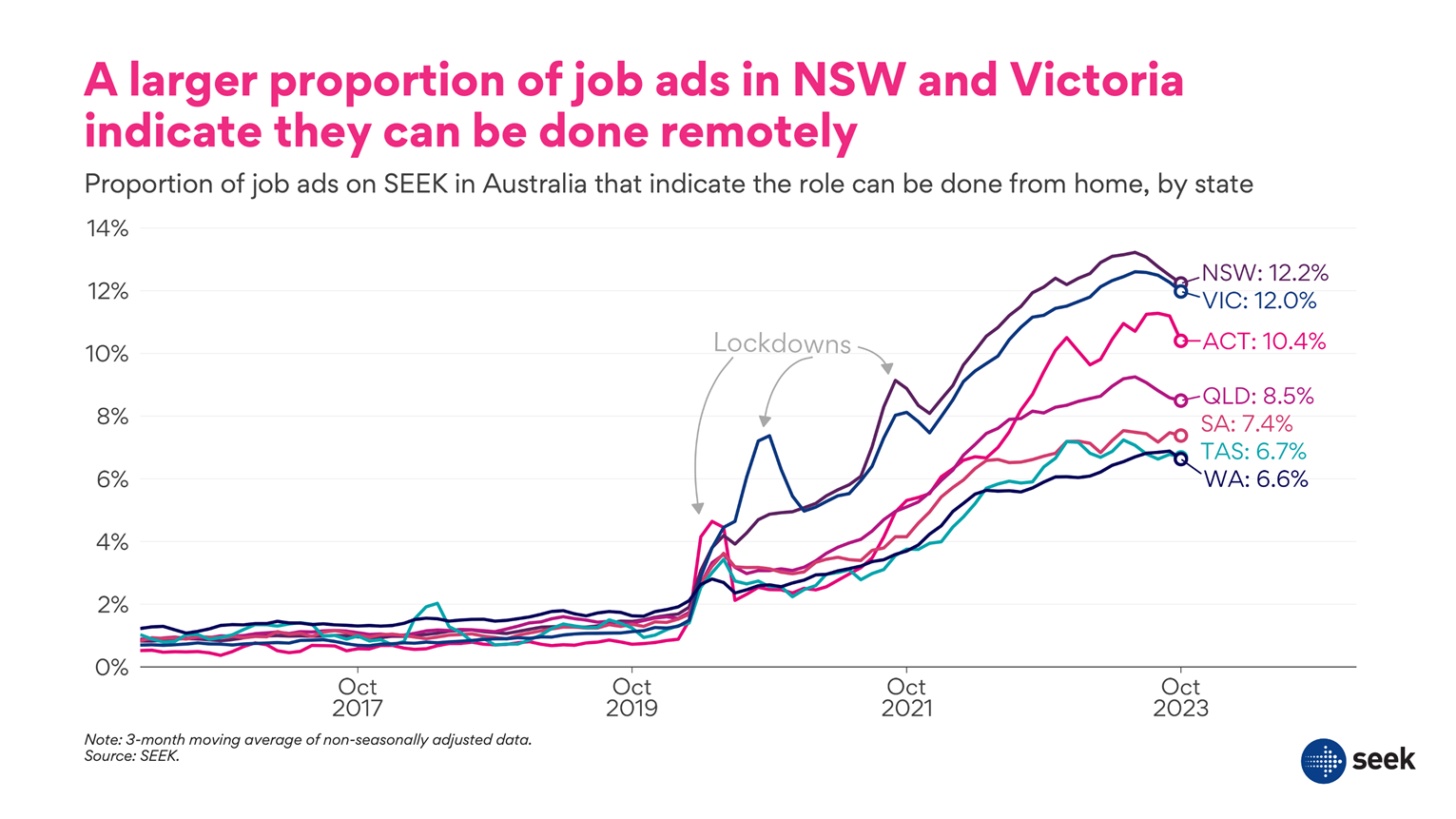

The WFH rate varies quite substantially across Australia. In NSW, 12.2% of job ads indicate the role can be done from home; in WA, the rate is a little over half that at 6.6%.

These differences between the states are mostly driven by differences in the mix of jobs, with white collar professional jobs in industries like Finance, Consulting, and ICT being a bigger share of the workforce in NSW and Victoria than in other states.

States’ experience of lockdowns may also be influencing WFH trends – but the compositional differences in employment are a much bigger factor. This is shown by the fact that NSW’s WFH rate is slightly higher than Victoria’s, despite the southern state’s much more extensive experience of lockdowns during 2020 and 2021.

Foot traffic in CBDs confirms WFH hasn’t gone away

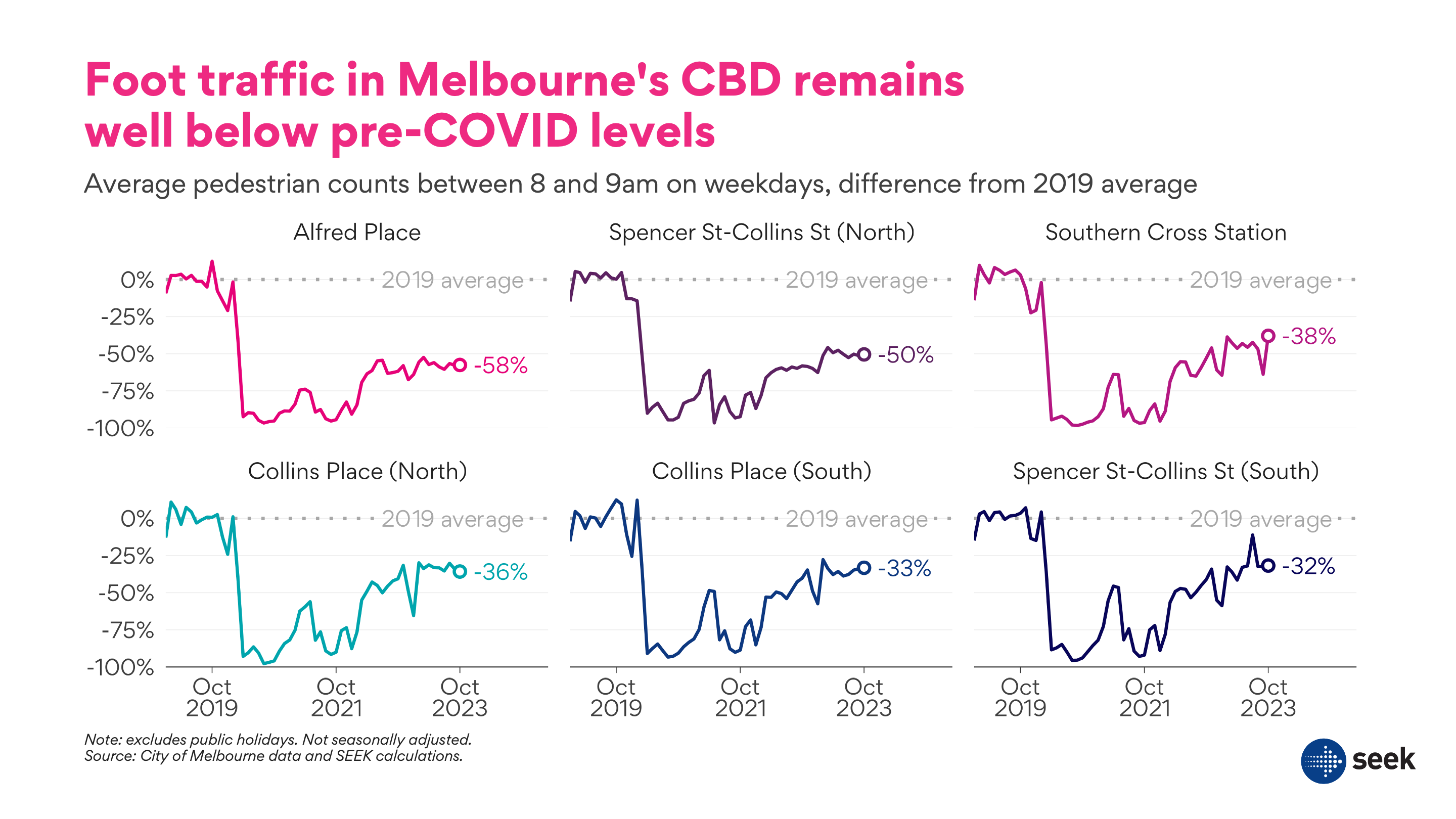

Other data confirm that we’re still a long way from pre-COVID normal when it comes to work location and commuting patterns.

For example, according to City of Melbourne data, weekday pedestrian traffic in Melbourne’s CBD during the 8-9am commuter peak is well down on 2019 levels. Pedestrian counts on the corner of Spencer and Collins Streets on weekday mornings are down nearly 50% on 2019 levels, and Alfred Place, a laneway off the Paris end of Collins St, is down nearly 60%. A range of Melbourne CBD locations tell broadly the same story: not only is weekday foot traffic well down on 2019 levels, there’s no sign of an upward trend during 2023. The data doesn’t suggest a slow return to more in-office work – instead, we appear to have plateaued around current levels.

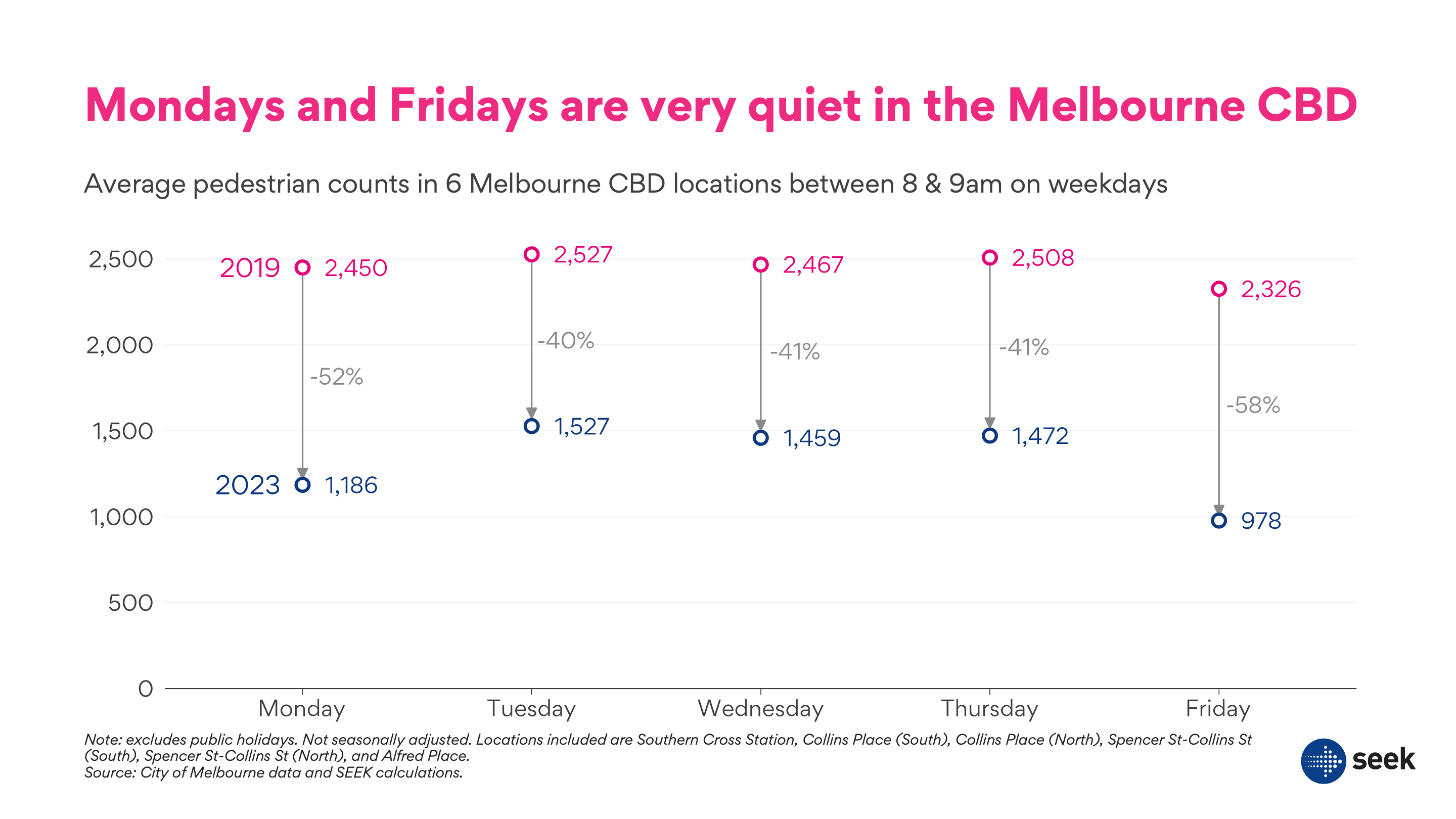

The foot traffic data also provide a clear illustration of when office workers are staying home. Tuesdays, Wednesdays and Thursdays are seeing about 40% less foot traffic in the mornings than they did in 2019. But Mondays and Fridays are down much more, 52% and 58% respectively.

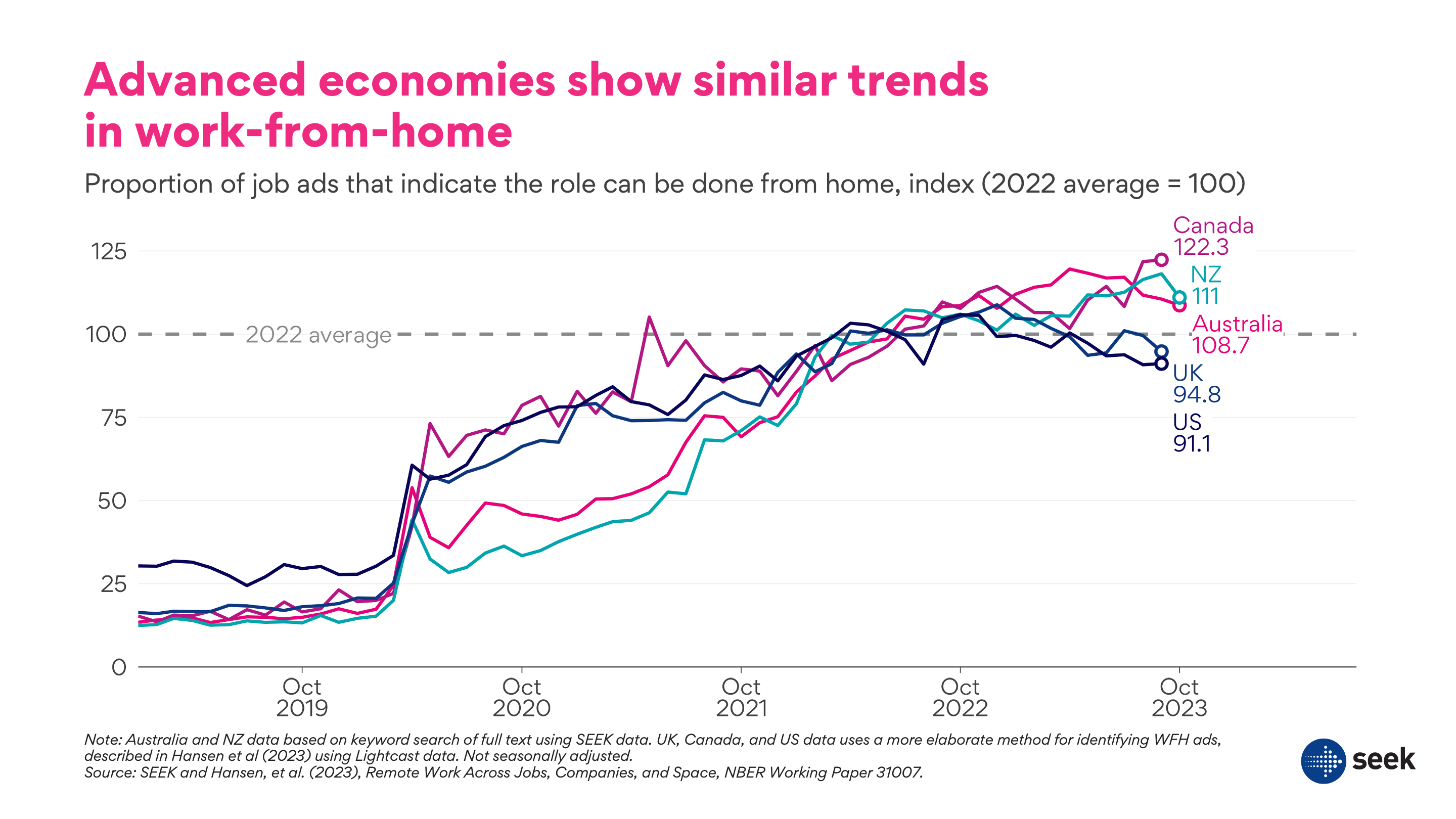

Work-from-home trends are similar across advanced economies

COVID-era trends in working from home in other advanced economies have followed a broadly similar trend to Australia’s. The proportion of job ads that indicate the role can be done from home is either at its peak (Canada) or close to it (New Zealand, US, UK), with only modest declines since the peak.

The WFH rate for Canada, the US and UK comes from different data, with work-from-home ads identified using a different method. For this reason, comparisons between the level across countries may not be meaningful. But the comparison within countries over time is informative, and the trends are broadly similar across each of these countries. Working from home shows no sign of receding to anything like pre-COVID levels. Each country remains around a similar level as in 2022.

SEEK’s unique data gives us a perspective not only on the employer side of the work-from-home equation, but also the jobseeker side. Future SEEK Economist Insights pieces will examine the demand for WFH roles from candidates, and the effect that WFH is having on the market.

-ENDS-

About Matt Cowgill

Matt Cowgill is SEEK’s Senior Economist, a position he has held since late 2021. At SEEK, Matt focuses on leveraging SEEK’s unique data to develop insights about the labour market.

Matt’s experience in analysing the labour market has been developed at Grattan Institute, the International Labour Organization, the Victorian Government and elsewhere.

Matt has a Masters in Economic Policy from the University of London, and undergraduate degrees in economics and political science from the University of Western Australia.