Compliance roles are trending - Australia sees a 48% increase in compliance and risk job roles

New SEEK data shares the latest employment trends across Australia, revealing that within the Banking and Finance sector, adverts for Compliance and Risk job roles have increased by 122% in the last five years, with a dramatic 48% increase in the last year alone. Currently 13.5% (as of October 2018) of Banking and Finance roles on SEEK are in Compliance and Risk.

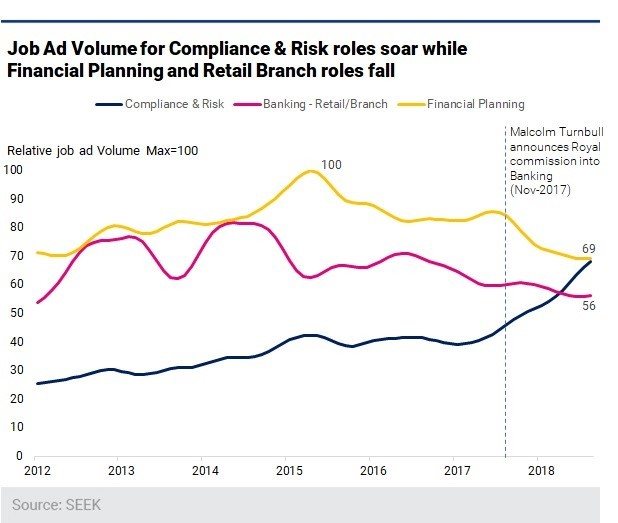

Beyond Compliance and Risk job adverts increasing significantly, there is extensive change occurring for employment opportunities within the Banking and Finance sector, which is visible in the ‘role types’ featured in SEEK job ads. The Banking and Finance sector has slightly increased in jobs (by 1% when comparing the three months to October in 2018 to the previous year), resulting in the category having relatively flat employment opportunities compared to the previous months, with falls in Financial Planning and Retail & Branch job adverts.

GRAPH 1 & 2 TITLE: JOB ROLES AVAILABLE IN BANKING AND FINANCE

COMPLIANCE AND RISK ROLES

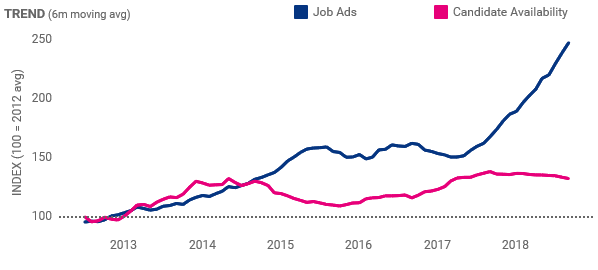

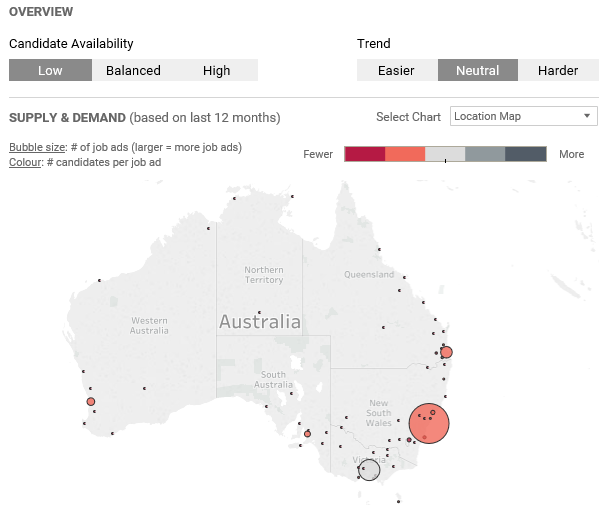

There has been a 13% increase over the past 12 months in candidates searching for compliance and risk roles on SEEK. However, there is still a shortage of candidates to fulfil jobs advertised in areas such as NSW, Brisbane and Perth (see Graph 4).

Kendra Banks, ANZ Managing Director from SEEK comments: “Compliance and risk job roles require an extremely niche skill set which can vary across different industries. Therefore, it can be hard for recruiters to find the right person for the role, or for candidates to even know that these roles exist outside of Finance and Banking institutions. Based on SEEK’s most recent data, we do anticipate seeing an increase in candidates looking for these types of roles over the next year.”

GRAPH 3 TITLE: COMPLIANCE AND RISK JOB ADS VS. CANDIDATE AVAILABILITY

GRAPH 4 TITLE: CANDIDATE AVAILABILITY IN COMPLIANCE AND RISK ROLES OVER THE LAST 12 MONTHS

AVERAGE SALARY IN COMPLIANCE AND RISK (OVER PAST 12 MONTHS)

Full time salary varies across the different career lifecycle for compliance and risk roles as follows:

- Junior: $74,142

- Mid: $96,710

- Senior: $130,776

- Manager / Head of: $135,391

- GM/Exec Level: $191,667

- Overall average: $121,419

WHAT HAS SPARKED THIS TREND?

Corey Babich, Manager in Financial Services for recruitment company Charterhouse shares why they believe there has been a shift in available compliance roles: “The Royal Banking Commission in Australia over the last year has led to a direct increase in compliance and risk roles being mandated by clients across all sub-segments of the Financial Services and Insurance sectors. Specifically, deep-dive knowledge around conduct, service commission models and advice have all been highly sought after in the candidates our clients are seeking to meet.

Kendra Banks, ANZ Managing Director from SEEK comments: “Big Data is a term used frequently amongst brands, particularly those who have an online presence and whose functions rely heavily on the use of technology and customer details. With the latest regulations on GDPR and several breaches seen across global businesses, it’s likely this has also contributed to the number of compliance and risk roles available. SEEK ensures jobseekers are in full control of their profiles and what is shared with recruiters and potential employers and we have a dedicated team working hard to keep jobseekers data safe.”